- General Information About Rating

- Corporate Credit Rating Methodology

- Bank and Financial Institutions Credit Rating Methodology

- Corporate Governance Rating Methodology

- Structured Finance

- The Methodology of Country Rating

- Project Finance Rating Methodology

- Rating Methodology of Local Authorities and Their Issuances

- Multilateral Development Banks, Financial Institutions, Other Supranational Institutions Rating Methodology

- Sovereign Rating Methodology

- Public Enterprises Rating Methodology

- General Principles for Issue Rating

- JCR-ER Rating Update Policies

- Case of Default and Probability of Default Definitions

- Notations

- Statistics

OVERVIEW AND SCOPE

The banking sector plays a critical role in supporting economic growth, ensuring the efficient allocation of resources, channeling savings into investments, and maintaining financial stability. Beyond their core functions of lending and deposit-taking, banks constitute fundamental components of the economic system through payment systems, financial intermediation, capital market integration, and risk management mechanisms. A sound and resilient banking system is one of the key pillars of sustainable development and macroeconomic stability.

Within this context, the analytical assessment of banks’ financial soundness, institutional structure, risk management capacity, and asset quality is of strategic importance not only for investors, regulatory authorities, and depositors, but also for the overall credibility and stability of the financial system.

The JCR ER Banking Rating Methodology aims to assess banks’ creditworthiness (debt repayment capacity) by incorporating both quantitative factors (such as financial ratio analysis, capital adequacy, asset quality, liquidity indicators, etc.) and qualitative factors (including institutional structure and management capacity, diversification and competitiveness, operational efficiency, corporate governance, and risk management practices). This assessment framework is designed to be consistent with international rating standards and to provide a comparable and repeatable analytical structure. Accordingly, banks’ credit risk profiles are evaluated in a holistic manner based on financial performance, funding structure, capital buffers, asset quality, liquidity management, and governance practices. The methodology considers both structural and cyclical risk factors and assesses banks’ short- and long-term obligation fulfillment capacity, profitability sustainability, and sectoral positioning.

The JCR ER Banking Rating Methodology adopts a multi-dimensional approach to analyzing banks’ financial and managerial capacities. The explanations presented herein summarize the methodological framework and evaluation criteria applied by JCR ER for banks. The criteria organize the analytical process under a common structure and define the steps for deriving a Bank’s Baseline Risk Profile (BRP), Standalone Risk Profile (SRP), and ultimately the Bank Credit Rating (BCR).

Within the scope of the methodology, banks’ financial data for the most recent three years are taken into consideration. The validity period of the ratings assigned under this methodology document is one year.

SEGMENTATION

In Türkiye, banks are classified into three main categories in accordance with the Banking Law No. 5411 and BRSA regulations, based on their business models, funding structures, and risk profiles: deposit banks, participation banks, and development and investment banks. This classification reflects the existence of structurally different dynamics among banks in terms of fund collection methods, lending approaches, and balance sheet composition. In the rating process, this distinction necessitates the proper measurement of risk parameters specific to each banking group and the calibration of financial ratios accordingly.

Under the JCR ER Banking Rating Methodology, banks are assessed under three separate segments:

-Deposit Banks

-Participation Banks

-Development and Investment Banks

For each segment, distinct evaluation criteria have been established by taking into account sector risk and risk profile characteristics.

Deposit banks primarily fund their operations through deposits within the legal framework and operate with credit portfolios that are broadly diversified across customer bases and typically short- to medium-term and cyclical in nature. In this segment, banks’ financial risk profiles are evaluated based on key financial indicators such as capital adequacy, asset quality, profitability, and liquidity, with particular emphasis on the risks and resilience arising from deposit-based funding structures.

Participation banks conduct fund collection activities based on participation (profit-sharing) funds and operate in line with interest-free banking principles. The financial risk profiles of participation banks largely resemble those of deposit banks in terms of core financial indicators such as capital adequacy, asset quality, liquidity, and profitability. Accordingly, no separate quantitative modeling has been applied for deposit and participation banks in terms of financial ratios, and differentiation is mainly achieved through qualitative assessment questions. In this framework, participation banking–specific business models, product composition, and risk management mechanisms are reflected in the ratings through qualitative criteria.

Development and investment banks, on the other hand, have fundamentally different risk profiles compared to deposit and participation banks due to their funding sources, asset structures, and business models. These banks mainly operate through long-term, project-based lending, wholesale funding, and international financing sources, without collecting retail deposits or participation funds. This structure creates material differences in liquidity management, maturity matching, asset quality, and income generation, necessitating the application of a separate financial and analytical framework for these institutions.

Accordingly, the JCR ER Banking Rating Methodology is designed as segment-specific models to ensure that differences in banks’ business models, funding structures, and risk dynamics are accurately and consistently reflected in rating outcomes.

BANKING RATING METHODOLOGY

Core Framework

The JCR ER Banking Rating Methodology aims to analyze, within a holistic framework, the key factors determining a bank’s debt repayment capacity, capital and liquidity flexibility, and financial sustainability. In this context, the methodology focuses on understanding how a bank’s business model, funding structure, balance sheet composition, operating strategy, and risk management practices interact with the macroeconomic and regulatory environment in which it operates. Accordingly, internal dynamics shaping bank performance and external factors arising from sectoral, economic, and regulatory conditions are assessed in an integrated analytical framework.

While comprehensively analyzing banks’ quantitative financial indicators (such as capital adequacy, asset quality, liquidity and funding structure, profitability, and efficiency), the methodology does not limit the assessment to these metrics alone. Qualitative factors (including management quality, governance structure, operational efficiency, risk management, diversification and competitiveness, regulatory compliance, information systems, and ESG practices) are also incorporated. This approach enables a holistic assessment of both a bank’s financial resilience and the governance and strategic framework shaping that resilience.

This approach is based on a methodological discipline aligned with Basel regulations, BRSA legislation, International Financial Reporting Standards (IFRS), and the prevailing macro-financial outlook. Through this multi-layered structure, banks’ risk-bearing capacity, vulnerabilities, and long-term resilience are evaluated in line with international norms while also accounting for local market conditions.

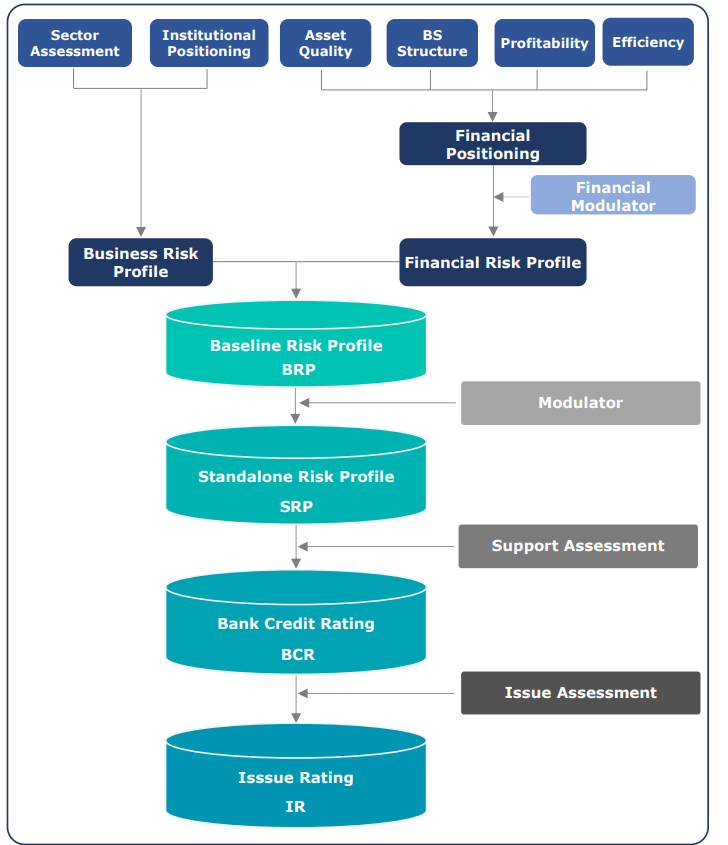

The JCR ER Banking Rating Methodology relies on a multi-layered framework that structures the analytical process and ensures the systematic evaluation of all critical components. Accordingly, the analysis is primarily divided into two main areas: Business Risk Profile and Financial Risk Profile.

In the construction of the Business Risk Profile, the sector assessment and the institutional positioning analysis are evaluated in an integrated manner. The Business Risk Profile incorporates both qualitative and quantitative elements; factors such as management capacity, institutional and ownership structure, risk management practices, operational efficiency, technological infrastructure, ESG practices, competitive strength, and business diversification constitute the key risk drivers that differentiate banks from one another.

The Financial Risk Profile is predominantly based on quantitative indicators. Within this framework, the analysis focuses on balance sheet composition, funding structure, efficiency indicators, asset quality, profitability, and capital adequacy. The Financial Risk Profile consists of two main sub-components:

-Financial Positioning, which covers indicators related to balance sheet structure, operational efficiency, asset quality, and profitability; and

-Financial Modulators, which involve the assessment of liquidity and capital buffers.

As a result of these analytical stages, the Business Risk Profile and the Financial Risk Profile are combined through a predefined risk matrix established within the methodology, leading to the determination of the Baseline Risk Profile (BRP).

Following the determination of the BRP, additional factors that may positively or negatively affect the bank’s overall risk profile beyond core financial indicators are assessed under the modulator framework. These modulators may result in an upward or downward adjustment of one or more notches to the Baseline Risk Profile, or may have no impact. Upon completion of this stage, the Standalone Risk Profile (SRP) is derived.

Once the Standalone Risk Profile has been established, potential supportive or weakening effects arising from the bank’s group affiliation or relationship with the public sector are analyzed. Group support or government-related support may lead to upward or downward adjustments to the bank’s credit rating. Accordingly, the final Bank Credit Rating (BCR) is determined based on this assessment. In cases where the rated bank issues a bond or note that does not fall within the scope of covered bonds (CB), mortgage-backed securities (MBS), or Sukuk, issuance-specific evaluation criteria are applied, and an Issue Rating (IR) is assigned to the relevant financial instrument.

Bank Rating Methodology Framework

Business Risk Profile

The Business Risk Profile is determined through the combined assessment of sector risk assessment and institutional positioning analysis. While the sector assessment analyzes the structural risks of the sectors in which the institution operates, the regulatory and supervisory framework, financial risk indicators, sensitivity to macroeconomic and external factors, and the relative importance of the sector within the financial system, the institutional positioning analysis evaluates the institution’s current and targeted positioning relative to its peers.

Within the scope of the sector assessment, sectors in which financial institutions operate (such as banking, factoring, financial leasing, insurance, consumer finance companies, brokerage firms, payment service providers, and asset management companies) are classified according to relative risk levels ranging from very low risk to very high risk. In cases where sufficient quantitative data are not available for the relevant sub-sectors, the assessment is completed based on reasonable and well-justified expert judgment.

The institutional positioning assessment is based on a multi-dimensional framework designed to capture the institutional capacity underlying the bank’s financial performance, its risk-taking and risk management approach, competitive strength, and sustainability orientation. Within this framework, banks are systematically evaluated under the following headings: Institutional Structure and Management Capacity, Risk Management, Diversification and Competitiveness, Operational Efficiency and Technology, Compliance and Reputational Risk, and ESG. Evaluation criteria are differentiated depending on whether the rated institution is a deposit bank, participation bank, or development and investment bank.

Under Institutional Structure and Management Capacity, the analysis focuses on the bank’s operating history, the experience and stability of senior management, the sustainability of its growth strategy, and the maturity of corporate decision-making processes. The effectiveness of internal control and internal audit functions; branch network and ATM penetration for deposit and participation banks; and technical expertise and independent evaluation capacity for development and investment banks are considered critical indicators of whether the bank’s scale is supported by a sound governance framework.

Within the Risk Management dimension, the clarity of the bank’s risk appetite and the effectiveness of early warning mechanisms constitute the primary analytical starting points. The management of liquidity and market risks, earnings stability, authorization limits in treasury operations, and core deposit ratios for deposit and participation banks provide tangible insights into the bank’s risk-taking behavior. The strictness and effectiveness of credit origination and collection policies, recovery and restructuring strategies for problem loans, insurance coverage for operational risks, and the maturity of internal rating and validation mechanisms indicate the extent to which credit and operational risks are effectively controlled. Participation banks are assessed separately from a methodological perspective in terms of market risk management. While interest rate–driven risks are predominant for conventional banks, participation banks are primarily exposed to profit rate risk, foreign exchange and commodity risks, and asset-based transactions, which require different risk measurement and hedging instruments. For development and investment banks, project execution and non-completion risk is also assessed under this category.

The Diversification and Competitiveness assessment examines the bank’s market share and competitive position in light of income diversification, product and service range, and innovation capacity. The segmentation-based distribution of deposits or collected funds, the geographic and sectoral breakdown of revenues, and the segmentation structure of the loan portfolio provide key indicators of concentration risk and the resilience of the business model. From a funding perspective, reliance on deposits, concentration of deposits and loans among the top 20 customers, and the capacity to secure long-term funding from international development institutions and funds are critical determinants of funding diversification and competitive strength. Criteria related to deposits or collected funds are applied to deposit and participation banks but are not considered for development and investment banks. Furthermore, income diversification is assessed through a separate question for participation banks due to structural differences in their business models and income generation mechanisms. While interest income and market-related revenues dominate deposit banks’ income structure, participation banks rely primarily on asset-based, interest-free financing and investment activities; therefore, income diversification is measured in a manner specific to each banking model.

Under Operational Efficiency and Technology, the robustness of the bank’s cybersecurity infrastructure, the level of integration between digital and physical service channels, the maturity of the digital transformation process, and the degree of automation in operational processes are evaluated. Customer satisfaction, the share of non-branch transactions, the user-friendliness of mobile and internet banking platforms, and the level of digitalization in customer acquisition channels are considered key indicators of both operational efficiency and customer experience. The extent to which mobile banking applications cover the bank’s product range is also taken into account when assessing the coherence of the digital channel strategy. However, as development and investment banks primarily serve corporate and commercial clients, indicators related to mobile and digital banking are excluded from the business risk profile analysis for these institutions.

Within the Compliance and Reputational Risk framework, the bank’s regulatory compliance risk, the nature of its relationship with supervisory authorities, reputational standing, brand perception, and media visibility and recognition are assessed jointly. Weaknesses in this area are considered material vulnerabilities that may adversely affect the bank’s business model and funding conditions, irrespective of its financial performance. As reputational trust in participation banks is built on different foundations, this dimension is assessed through separate questions. While general brand strength and market confidence are decisive for other banks, participation banks are additionally evaluated based on perceptions related to adherence to participation banking principles and Islamic finance compliance, which constitute a fundamental component of customer trust.

Finally, under the ESG dimension, the proportion of independent board members, anti-corruption policies, transparency in reporting practices, and sustainability governance structures are examined. The management of climate-related risks, restrictive policies toward carbon-intensive sectors, measurement of carbon emissions, and the share of green assets reveal the bank’s environmental risk profile. Short-, medium-, and long-term sustainability targets; independent assurance of sustainability reporting; equal opportunity considerations in lending processes; dedicated credit practices for disadvantaged groups; and the share of loans generating social benefits reflect the bank’s social impact and responsible banking approach. The existence of a dedicated sustainability unit or authorized function is regarded as a key indicator of the extent to which sustainability commitments are embedded within the institutional structure.

The institutional positioning assessment defines a bank’s relative ability to leverage key sectoral factors or mitigate related risks more effectively, thereby achieving competitive advantages and a stronger business risk profile compared to peers that are more exposed or less resilient to sector risks.

The Business Risk Profile is ultimately determined through the consolidation of the sector risk assessment and the institutional positioning assessment.

Financial Risk Profile

The quantitative dimension of bank ratings primarily focuses on the institution’s financial resilience and its capacity to meet its obligations in a timely and full manner. Within this framework, the analysis adopts a holistic approach that considers balance sheet structure, asset quality, profitability, efficiency, liquidity buffers, capital adequacy, and the interactions among these components.

The sustainability and quality of income generated from core banking activities are critical determinants of both access to external funding channels and internal capital generation capacity. The stability of net interest income, the breadth and diversification of fee and commission revenues, and the volatility of market-related income streams are key indicators of the soundness of the income structure. In this respect, sound asset quality, robust liquidity management, balanced income diversification, and stable profitability performance constitute the core components shaping a bank’s debt-servicing capacity, resilience under stress conditions, and ultimately its credit rating.

The Financial Risk Profile is constructed through the combined assessment of Financial Positioning and Financial Modulators. Within the Financial Positioning framework, key areas of analysis include balance sheet structure (funding composition and loan-to-deposit or collected funds distribution), efficiency indicators (cost and expense ratios), asset quality (non-performing loans, Stage 2 loans, and provisioning policies), and profitability metrics (such as RORWAs, non-interest income, and margin indicators). Through Financial Modulators, capital adequacy, liquidity structure, and other regulatory ratios are predominantly analyzed, and their impact on the financial positioning outcome is reflected as either neutral or weakening. This approach ensures that the assessment goes beyond the mechanical interpretation of ratios and incorporates the consistency of these ratios with regulatory requirements and the institution’s overall risk profile.

Financial Positioning Criteria

The ratios used within the financial positioning analysis are grouped under the headings of balance sheet structure, operational efficiency, profitability capacity, and asset quality, with the objective of assessing banks’ financial resilience and risk profiles from a comprehensive and comparable perspective.

Balance sheet structure indicators reveal banks’ funding composition, capital adequacy, and asset–liability balance. In this context, metrics such as the free capital ratio and leverage ratio measure balance sheet flexibility and resilience to shocks, while for deposit and participation banks, the loan-to-deposit (or collected funds) ratio is taken into account to assess the alignment between credit growth and funding structure.

Efficiency ratios focus on analyzing the relationship between banks’ income generation capacity and cost structure. The ratio of operating expenses to operating income reflects the effectiveness of cost management, while indicators such as the interest coverage ratio and credit risk cost provide insight into the adequacy of operating profitability relative to funding costs and credit risk. For development and investment banks, indicators related to non-interest income and expense structures enable the assessment of business model–specific income diversification.

Profitability indicators measure banks’ ability to generate sustainable earnings under their prevailing risk profiles. Return on risk-weighted assets reflects the efficiency of capital utilization, while net interest margin and the share of fee and commission income in total revenues provide information on the stability and diversification of income composition.

Asset quality ratios are designed to assess the risk level of the loan portfolio and the adequacy of provisioning. The share of Stage 2 loans and the provisions allocated to these exposures allow for the monitoring of potential deterioration risks, while the net non-performing loan ratio highlights the persistent impact of credit losses on the bank’s balance sheet.

When assessed collectively, these indicators enable the evaluation of banks’ financial risk profiles and performance within a multi-dimensional and comparable analytical framework rather than through isolated ratios, and they provide key inputs into the financial modulator assessment.

Given that the level, volatility, and sensitivity of financial ratios may differ between deposit/participation banks and development/investment banks, the selected metric set, evaluation ranges, and methodological weights are differentiated based on the bank’s business model and scope of activities. The metrics considered under this methodology are determined in light of sector-specific structural characteristics, regulatory requirements, and historical data analysis, and are updated as necessary in line with changes in market conditions and the regulatory environment.

Financial Modulators

Following the financial positioning assessment, the application of financial modulators finalizes the bank’s Financial Risk Profile. These modulators constitute an additional analytical layer built on top of the core ratio-based financial positioning and are designed to evaluate the bank’s resilience to shocks as well as the adequacy of regulatory capital and liquidity buffers. In this assessment, minimum regulatory thresholds, supervisory ratios, and banks’ behavior under stress conditions as defined within the BRSA and Basel frameworks are given particular consideration.

Financial modulators used in constructing the Financial Risk Profile are grouped into three main categories: balance sheet structure, funding structure, and capital structure indicators. The specific modulator criteria are presented in the table below.

These indicators primarily reflect the bank’s level of preparedness against foreign exchange risk, sudden liquidity pressures, and unexpected credit or operational shocks, rather than profitability or efficiency. Ratios such as LCR and NSFR mainly capture liquidity and foreign exchange sensitivity, while balance sheet structure indicators (including leverage ratio, foreign currency position, and net interest income sensitivity measures) signal equity flexibility relative to balance sheet size. Capital adequacy ratios indicate loss-absorption capacity. When analyzed collectively, these metrics provide a holistic view of the bank’s ability to sustain operations and meet its obligations even under adverse scenarios.

The relevant metrics are directly linked to the regulatory framework. While BRSA and Basel regulations prescribe minimum threshold levels for certain ratios (such as LCR, NSFR, and capital adequacy ratios), other indicators are monitored for supervisory and early warning purposes. For deposit and participation banks, these modulators are an integral part of the business model due to reliance on deposit-based funding and short- to medium-term balance sheet structures. For development and investment banks, however, given the absence of deposit funding and the predominance of long-term project financing, liquidity ratios are considered more for monitoring purposes, whereas capital ratios are regarded as more decisive.

Within this framework, financial modulators are designed as a complementary analytical layer that can only exert a negative or neutral impact on the financial positioning outcome and do not provide upward rating adjustments. The rationale is that modulator indicators converging toward regulatory limits, falling below minimum thresholds, or exhibiting weakening trends under stress conditions increase the bank’s vulnerability to shocks and therefore justify downward adjustments; otherwise, their impact is reflected as neutral.

Each financial modulator is assessed individually, with legally defined ratios, minimum thresholds, and supervisory limits established under BRSA and Basel regulations serving as the primary reference points throughout the analytical process.

Baseline Risk Profile (BRP)

The Baseline Risk Profile (BRP) is the primary indicator reflecting the bank’s intrinsic credit risk, derived through a matrix-based and holistic integration of the business risk profile and the financial risk profile, and represents the institution’s standalone creditworthiness excluding any external support considerations. In other words, the BRP constitutes the fundamental reference rating obtained by consolidating findings related to the bank’s business model, sector positioning, and risk management capacity with assessments of balance sheet structure, profitability, asset quality, operational efficiency, liquidity, and capital adequacy under a single, coherent risk level.

Standalone Risk Profile (SRP)

Following the assessment of the Baseline Risk Profile (BRP), the Standalone Risk Profile (SRP) is determined by incorporating the results of the modulator assessment. The modulator framework considers additional factors that have the potential to materially alter the bank’s core risk profile.

This stage is designed to capture the impact of less frequent but potentially high-impact factors that may significantly influence the baseline rating. Modulators represent idiosyncratic conditions that are not directly embedded in the bank’s fundamental financial or qualitative profile but may exert a substantial effect on its overall risk profile. The presence of such factors may indicate either temporary shocks or permanent structural deterioration. The primary objective of modulators is to reflect extraordinary bank-specific risks or advantages that cannot be adequately anticipated by the model’s standard scoring mechanism. Modulator assessments influence the BRP outcome through the application of dedicated matrices or rating constraints (capping) defined for specific criteria, thereby forming the SRP.

Within this scope, factors that may materially and adversely affect future cash flows are analyzed, including but not limited to mergers, partnerships, and acquisition processes; systemic importance status; developments observed in interim financial statements; regulatory and licensing risks; exposure to severe penalties related to anti-money laundering (AML), counter-terrorism financing (CTF), and international sanctions or embargo violations; prolonged IT outages; large-scale cyberattacks; sudden and unplanned management changes; and management-related misconduct. In addition, the bank’s access to central bank facilities and other emergency liquidity sources, as well as the concentration level of high-risk sectors within the loan portfolio, are incorporated into the modulator assessment.

The modulator analysis constitutes a complementary assessment area encompassing institutional resilience, governance capabilities, sensitivity to external shocks, and systemic importance. At this stage, the analysis extends beyond financial indicators to include factors related to regulatory risk, license security, legal and regulatory compliance, operational continuity capacity, and strategic coherence. In this context, exposure to significant punitive risks—such as AML, CTF, or international sanctions and embargo violations—is closely monitored as a critical determinant of the bank’s long-term reputation and license to operate. Similarly, institutions designated as systemically important by supervisory authorities are expected to demonstrate higher levels of oversight, public confidence, and stress resilience in the interest of financial stability.

Interim financial performance and the macroeconomic outlook may signal material volatility in the bank’s asset quality or capital buffers. Furthermore, operational risks such as prolonged IT disruptions, major cyber incidents, or abrupt management changes are evaluated as event risks that may adversely affect liquidity flows and customer confidence. Regulatory and licensing risks reflect potential uncertainties regarding the continuity of the bank’s operating authorization, while access to central bank facilities and other emergency liquidity sources constitutes a key stabilizing factor during periods of financial stress. Lastly, credit concentration in high-risk sectors serves as a complementary indicator of portfolio diversification and resilience under stress scenarios. Taken together, the modulator assessment holistically evaluates external and idiosyncratic factors that may result in upward or downward adjustments to the bank’s credit rating.

Modulator assessments may have a positive, neutral, or negative impact on the Baseline Risk Profile. Depending on the outcome, the modulator assessment may result in an upgrade or downgrade of the BRP by one or more notches, or, in certain cases, have no impact on the BRP.

The evaluation results are derived through the assessment of responses to modulator criteria using various matrices. Depending on the relative importance of the criteria, rating caps (such as minimum thresholds or limits preventing ratings from exceeding or falling below predefined levels) may be applied. In addition, matrix structures differentiated according to specific criteria are utilized within the modulator framework.

Bank Credit Rating (BCR)

The Bank Credit Rating (BCR) is determined by incorporating bank-specific support assessment results into the Standalone Risk Profile. The support assessment represents a complementary analytical area aimed at evaluating the potential for financial and structural support from external sources. In this context, the financial strength of the bank’s group, historical support behavior of the parent and affiliates, their current financial capacities, and potential support obligations are assessed collectively. The likelihood of liquidity or capital support to the bank is directly linked to the group’s strategic coherence, level of operational and financial integration, and the reputational risk borne by the parent entity. Accordingly, potential direct loans, liquidity facilities, or capital injections from the parent or affiliated entities are viewed as key stabilizing elements supporting liquidity continuity and debt-servicing capacity during periods of financial stress.

The second dimension of the support assessment focuses on the bank’s relationship with the public sector and potential implications arising from the regulatory environment. In this regard, the extent of public ownership and managerial control is analyzed; the presence of direct public shareholding or decisive public influence over management may indicate a higher likelihood of direct or indirect support when needed. Furthermore, the potential adverse impact of a disruption in the bank’s operations on the broader banking sector or public confidence is considered in assessing the expected level of government support aimed at preserving financial stability and societal trust.

In addition, recent changes in legislation, taxation, or incentive schemes that may affect the bank’s operations and profitability are incorporated into the analysis. The potential impact of such regulatory developments on cash flows, business model sustainability, and capital structure is treated as a complementary factor within the support assessment.

The support assessment process first evaluates group-related support, followed by an assessment of public sector–related support. Where such factors are present, the SRP may be revised upward or downward accordingly. Following the incorporation of support considerations into the Standalone Risk Profile, the Bank Credit Rating (BCR) is derived.

In cases where, due to the specific characteristics of the sector in which the rated bank operates or its idiosyncratic circumstances, the information provided is insufficient to fully explain the bank’s creditworthiness, or where bank-specific data required by the methodology is unavailable, the missing information is duly considered by the Rating Committee, which ultimately determines the bank’s final rating.

Issue Rating

While the issuer’s capacity (reflected in the issuing bank’s credit rating) constitutes the core component of issue ratings, issue-specific conditions may lead to differentiation between the issue rating and the issuer’s rating. Issue ratings are primarily assessed based on a security-specific set of criteria, including collateral structure, legal and structural features, payment seniority, and the presence of guarantees or additional credit enhancement mechanisms, where applicable. Nevertheless, the critical anchor of the analysis remains the issuer’s BCR. The criteria applied in issue analysis are not intended to establish an independent credit profile exceeding the BCR; rather, they may contribute positively to the rating or remain neutral where the issue profile demonstrates stronger characteristics relative to the issuer. This reflects the fundamental principle that payment obligations arising from the issuance are economically and directly linked to the issuer’s creditworthiness. Accordingly, issue ratings are determined within a framework consistent with the issuer’s BCR, with issue-specific criteria serving solely a reinforcing or confirmatory role.

Issue ratings may be assigned on a long-term or short-term basis. Debt instruments with an original maturity exceeding one year are assigned a long-term issue rating, while instruments with a maturity of one year or less are assigned a short-term issue rating.